Catastrophe bonds: Financial innovations insuring against severe climate events (or high-loss level events)

This article was originally drafted by Fernando Prada and the FORO Nacional Internacional as part of the Rockefeller Foundation’s Searchlight Process. For more Searchlight content on futurechallenges.org, please click here.

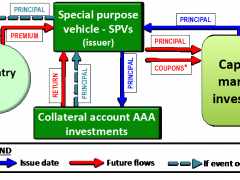

The vulnerability to natural disasters of communities in Latin America and the Caribbean is increasing, yet governments are prioritizing responses to disasters rather than prevention. Catastrophe bonds, also known as CAT bonds, are a potential solution for timely cash in case of high-loss events. As Figure 1 indicates, a special purpose vehicle (SPV), sponsored by a country, issues a CAT bond. The SPV invests the proceeds in AAA-rated assets and pays coupons to investors from the returns on the investment and the premium paid by country X. If no disaster event occurs during the life of the bond —usually 3 to 5 years—, the SPV returns the principal to investors at maturity.

Diagram of a CAT bond structuration. (By FORO Nacional Internacional)

A key element of CAT bonds is what will trigger payments from investors. A trigger is defined with a parameter, usually the intensity of a natural event at which investors have to pay. Most CAT bonds are related to hurricane or earthquake intensity levels in a specific territory.

The Inter-American Development Bank has joined the World Bank in encouraging investors to channel resources towards development initiatives through innovative financial market instruments. Nevertheless, there are only few experiences because of high transaction costs that require issuing above US$100 million to become cost-effective. Only Mexico has issued CAT bonds in the LAC region.

The integration of stock exchanges of Peru, Colombia, and Chile under the Latin America Integrated Market (MILA in Spanish) agreement, which is operating since May 2012, provides an opportunity to disseminate the use of CAT bonds and similar financial innovations. These three countries share a high exposure to catastrophes, as well as an outstanding growth of their domestic capital markets during the last decade. Still, efforts to expand CAT bonds are likely to encounter difficulties:

- CAT Bonds are data hungry, and most countries lack sufficient historical information collected through adequate observations. International organizations could support national and regional scientific institutions to systematize existing data. Recently, the World Bank approved a US$250 million loan to Colombia in order to create 300 risk management plans in municipalities with a high incidence of vulnerable populations.

- Political will from governments and financial regulators is key. CAT bonds translate risk from disaster-prone areas to capital markets, since investors would pay the principal if an event occurred. However, supply does not create demand, and regulators need to make sure that investors will be interested in these instruments. Other countries in Europe and the United States are now experimenting with CAT Bonds and middle-sized insurers.

- Introducing new instruments requires important investment in providing information, training financial operators and guaranteeing a periodical supply of these bonds to potential investors. One investor indicated to the New York Times Magazine that “my boss will not let me buy bonds that I have to watch The Weather Channel to follow.” But CAT bonds provide hedging against market volatility because they are not correlated to economic events. This is one reason behind the CAT bonds return to its pre-crisis level of US$14 billion outstanding capacity in developed countries. Insurance companies were the main issuers in 2012.

Stock exchange in Brazil. (By Fernando Stankuns from flickr.com CC BY-NC-SA 2.0)

These are still public resources and public institutions absorbing a great share of risks from disastrous natural events. If these arrangements are successful and in demand as climate events become stronger and more costly, they could eventually impose trade-offs to scarce public resources. In the future, South American stock exchanges will become more sophisticated and quickly catch up with developed countries’ financial innovations —CAT bonds included. The MILA is a step in this direction and is willing to compete with Brazil and Mexico’s stock exchanges.

There is a strong case to progressively transfer risks to the private sector in order to free up public resources for other development purposes. This could be done by encouraging private investors to absorb high-loss disaster risks using CAT bonds. By teaming up with international organizations, South American countries, particularly market-friendly Peru, Colombia, and Chile, could contribute significantly to creating evidence on how these instruments work in the field. The following steps would be extending these instruments to medium sized insurers and covering riskier areas by reducing transaction costs, and, of course, investing in capacity to respond to disasters now that cash could be more accessible.

Sources:

- Keipi, Holm and Miller (2007), From disaster response to prevention companion paper to the disaster risk management policy, Washington D.C.: Inter-American Development Bank Sustainable Development Department (ENV-150).

- Murphy, Hartell, Cárdenas and Skees (2012), “Risk management instruments for food price volatility and weather risk in Latin America and the Caribbean: the use of risk management instruments”, IFD Discussion paper No. IDB-DP-220.

Tags: bonds, Caribbean, CAT bonds, Catastrophe bonds, finance, financial innovations, FORO Nacional Internacional, investment, Latin America, natural disaster, Rockefeller Foundation, Searchlight, stock exchange