The GES2011 (Food for) Thought Lab

The Global Economic Symposium is not only about high-level decision-makers coming together to network, to deliver addresses, to propose daring solutions in off-the-record-sessions and to get occasionally interviewed for the Future Challenges YouTube Channel. It’s also about academics, administrators and even politicians sharing innovative ideas, at various stages in their development, on shaking the fundaments of global cooperation.

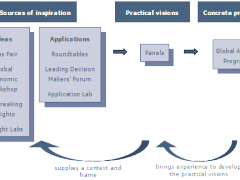

The overarching concept is that sources of inspiration (roundtables, the Ideas Fair, the Global Economic Workshop, Thought Labs and the very impressive community of Global Economic Fellows) feed into practical visions elaborated by highly experienced professionals and then translate into concrete projects via the Global Action Program. The loop is circular nonetheless, as the diagram above indicates.

This having said, the Thought Lab I attended today succeeded in keeping my attention span at top levels, despite having attended three very intensive panels, written two articles and conducted three interviews during the day. Prof. David Tuckett, Director of Emotional Finance Project at the University of London joined hands with Anthony Gooch, Director of Public Affairs and Communications at OECD to share with the audience some of their cutting edge tools to address pressing global issues.

Prof. Tuckett, whom I happened to briefly interview the day before, is the author of the book Minding the Markets, probably one of the most recent highlights of behavioural economics as academic discipline. Spanning from John Maynard Keynes’ “animal spirits”, i.e. the emotions that shape our behaviour and ultimately reconfigure economic markets as well, and going all the way to the more contemporary theories of Akerlof and Shiller, behavioural economics promises us that we can organize financial markets based on an improved knowledge of the human behaviour. The price of a financial asset is decided by a story constructed by the trader, and in in which he/she decides to believe based on feelings of excitement and anxiety. After having read Nassim Taleb‘s Black Swan some months ago, I felt tempted to dismiss the crisis starting in 2008 as one of those historical, once in a lifetime exogenous black swans that can be neither anticipated, nor easily solved. Prof. Tuckett made me get out of this comfort zone and imagine how brilliant it would be if regulators themselves could “create stories” (when, for instance, they see the price of an asset get out of historical patterns) and in this way create anxiety among speculators…

Moving from the abstract spheres of emotional finance (which can nonetheless provide some pretty compelling grounds for evidence-based decision-making), Anthony Gooch’s presentation on the Better Life Index developed by OECD made me regain confidence in the potential for innovation of public institutions. After seven years of work, the OECD has created an interactive tool that allows individuals to compare well-being across countries. The whole buzz around needing to move beyond GDP as a measurement of progress might just have found a response. 25 individual indicators make up the 11 topics of well-being that the index is aggregating, users can define their own index based on personal preferences and then see how countries prioritize different policies based on it. I could bring some methodological critique regarding the validity of the index’s subjective indicators, but I’ll refrain. I’m simply thrilled international organizations think out of the box in terms of knowledge production!

http://www.youtube.com/watch?v=n2Zqj6CzDXs