Central banking in times of crisis and its future – introducing

The following article deals with the topic “The Future of Central Banking: Inflation Targeting vs. Financial Stability” which will be discussed at the Global Economic Symposium in Rio this October. The author intends to enrich the discussion at the symposium with his personal stories and ideas.

First of all, I guess a brief introduction is in order. I’m an economist based in São Paulo, Brazil; 32; working in financial markets since months before the great Argentina default of 2001. Though I was a fairly decent undergrad student, I think I developed most of my current strengths from learning with some brilliant bosses and colleagues with whom I was lucky to work and from my almost unstoppable urge to understand how the world works (together with the belief, held from a very early age, that, as a Brazilian journalist put it, there’s no alternative to reading). The extremely nice people from Bertelsmann Foundation found me through my blog in Portuguese, and conceded me the honor of writing about the future of central banking for Future Challenges. So, here I am.

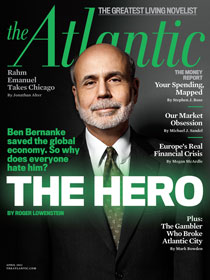

Discussing this topic is important to me mainly because never in history have central banks concentrated so much power, and never have the expectations of and trust in their actions been so high as they are currently (as an example, take a look at the iconic cover of last April’s issue of The Atlantic, pictured right). I believe we’re living through times of very difficult political coordination in the developed world: one of the paradoxical legacies of several decades of prosperity and stability is a very powerful defense of the status quo (partly because, as late historian Tony Judt said, there’s too much to be preserved), hence little disposition for taking risks in the form of bold action that could damage the current arrangements of power and privileges. In this environment, central bankers became the quintessential technocrats, with a mandate for discretionary action, no need of political legitimacy, and an aura of neutrality and technical knowledge.

I see at least a couple of major problems with this current state of affairs. First, as mentioned above, lack of political legitimacy: most of the more powerful central banks in the world conquered formal independence in a period when their mandates were clear and very specific, limiting their actions. Today, central banks remain independent, but their actions increased in scale and are clearly spilling over the boundaries of price stability and maximum employment. Central bankers started to share responsibilities in financial regulation, asset prices (not only bonds – both Bank of Japan and Bank of Israel are currently buying equities) and even income distribution. These are among the most important decisions in economic policy, and electors should make certain that responsible officials are accountable for their acts.

Second, the central banks’ direct control over just one macroeconomic variable (the short term rate of interest) leads to the risk of using it as the proverbial Abraham Maslow’s hammer and treating everything as if it were a nail. Many of today’s economic problems cannot be addressed only with monetary policy, and doing so entails complex and still poorly understood collateral effects, such as distortions in the cost of capital and transference of risk from private players to central bank balance sheets and all the associated moral hazard.

Maybe we’re living in war times, when rules are supposed to be different – and transitory. It’s of crucial importance for academics, media and policymakers to think about these new rules, their consequences and how the future will possibly look. Central banking is likely to continue playing a pivotal role in the lives of billions of people; over the next few months, I’ll try to use this space to give my two cents on this discussion. Comments, criticism and suggestions are more than welcome.