Macroeconomic effects of TAFTA/TTIP

Abstract: According to a purely macroeconomic perspective, a comprehensive free trade agreement between the US and EU is beneficial for both parties. Although different model calculations arrive at different quantitative conclusions, all calculations share the assessment that TAFTA | TTIP will increase real gross domestic product and employment both in the US and in EU member countries. On the other hand, estimates about the economic consequences for the rest of the world are ambiguous. The first (theoretical) part of this article explains how the reduction of trade barriers is able to increase economic growth and employment with the help of a simple graphical analysis. The second (empirical) part presents core findings of a recent study of the Munich ifo Institute commissioned by the Bertelsmann Stiftung. This part of the article also debates the limitations of economic model calculations. For economists the most important aspect of any free trade agreement is the removal of barriers of trade. Dismantling such barriers reduces the costs of trade activities between the contracting economies. And due to the increase of trade flows, economic analysis predicts economic growth as well as an increase in employment.

Economic Consequences of Tariffs

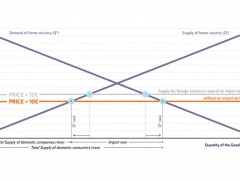

In order to explain the impact of a free trade agreement, let us use a simple graphical example. In this example we have one good and two countries (domestic country and foreign country). The good is produced and consumed in both countries. Domestic consumers determine the amount of the good they want to buy according to the price of the good. Normally consumers have a low demand for any good if the price is high and they increase their demand if the price falls. Domestic companies fix the amount that they want to produce and sell according to the price they receive. If the price is low, they are only willing to produce a small quantity of the good, but if the price is rising, suppliers will increase production. Let us denote the amount of goods demanded by the consumers with QD and the amount of goods supplied with QS. The described relationship between prices, demand and supply can be transferred into a diagram with two axes: one price-axis (P-axis) and one axis with the quantity of goods produced and consumed (Q-axis). In this figure – due to the assumptions we made concerning demand and supply behavior – demand curve slopes downward whereas the supply curve has an upward slope (see figure 1).

Let us assume that the foreign country is a large economy that is able to produce a large amount of the good we are talking about. To be more concrete, we assume that the foreign country is able to provide any amount of the good at a constant price, for example at a price of €10. The domestic country levies a tariff on each single unit of the good imported from abroad in the amount of €2. Thus domestic consumers have to pay €12 for this good. Since we assume that foreign companies can produce any quantity of the good demanded by domestic consumers at a constant price, domestic suppliers cannot claim a price higher than €12. If the price should be higher than €12, domestic consumers would only buy foreign products. In other words: the price domestic companies can charge is determined by the price of the foreign country.

If we incorporate these assumptions into figure 1, the supply curve of foreign companies is represented by a line parallel to the Q-axis. The intersections between the foreign supply curve and the two curves describing domestic supply and domestic demand indicate the amounts of the good supplied by domestic companies and the quantity demanded by domestic consumers. At a price of €12, all domestic companies offer a total quantity which is represented by the line 0QS. The quantity of goods bought by domestic consumers is represented by the line 0QD. Domestic demand is larger than domestic supply, but excess demand is covered by the goods offered by foreign companies. Hence the imports are represented by the line QSQD.

Now let us assume that both countries decide to sign a free trade agreement which abolishes all tariffs. In that case foreign companies can sell their products at the original price without a tariff. Thus they will offer their products at a price of €10. For the graphical analysis this change implies a downward shift of the supply curve of foreign companies (see figure 2). The intersections of this new foreign supply curve with domestic demand and supply curves once again indicate domestic production, domestic demand and the volume of imported goods. Abolishing the import tariff has four main macroeconomic effects:

The price domestic consumers have to pay dropped from €12 to €10. Hence consumers gain purchasing power which they can spend for more units of the good we consider or for any other good.

The quantity of this good demanded and consumed by domestic consumers is growing. This is an improvement of material living conditions for domestic consumers.

If more units of a certain good are consumed, the entire production of this good has to rise, too. Therefore we observe an increase in production activities and thus economic growth. And since in many cases a larger production implies a higher level of employment, we can expect an increase in employment.

The import volume increases whereas the amount of goods produced by domestic companies is shrinking. Thus – not surprisingly – foreign companies benefit from abolishing an import duty whereas domestic suppliers are displaced by suppliers from abroad.

According to a macroeconomic overall reflection, the dismantling of an import tariff is an economically beneficial matter: domestic consumers profit because they can enjoy a larger amount of consumer goods at a lower price. Foreign companies increase their production and thus increase employment. Of course, domestic companies have to reduce their production and thus reduce domestic employment. But if we take into account that in real economies we do not have just one single good but many different goods, domestic companies will have competitive advantage in the production of other goods. Hence domestic companies – and domestic workers – will lose shares on some markets, but they will profit from larger exports to the partner economy of the free trade agreement on other markets.

One last remark concerning economies which do not participate in the free trade agreement: if the contracting countries intensify bilateral trade activities, they need less goods and services from other economies. Hence economies outside the bilateral free trade agreement export fewer products to the members of the agreement. Fewer exports imply a lower level of production and a lower level of employment. Therefore a free trade agreement decreases production, economic growth and employment in the rest of the world.

Relevance of Non-tariff Barriers

Up to now this paper has considered tariff barriers to trade. Since tariffs between the US and the EU are already very low – on average import duties amount to 3% up to 4%– non-tariff barriers are much more important for transatlantic trade. Non-tariff barriers restrict the importation of goods and services from abroad by other means than import duties. Examples are: quality standards, technical requirements for imported products, and labeling requirements. All these requirements constitute an obstacle to export products to another country.

The main economic effect of non-tariff trade barriers is the implication that these barriers increase costs of production for companies that want to export their goods and services. If, for example, technical requirements demand different flashing indicators and anti-shock pads for cars used in the US than for cars driven within the EU, motor industry has to produce different cars for both markets. Producing two kinds of a certain product causes additional costs. Hence in economic analysis we can treat non-tariff trade barriers like import duties. Therefore the macroeconomic effects of abolishing non-tariff trade barriers are equivalent to a removal of import duties. The only difference refers to the aspect of time. If a free trade agreement decides to abolish import duties at the beginning of 2014, prices for imported goods and services decrease immediately. The removal of non-tariff barriers would need more time to be effective. For example, if the exportation of a certain European electronic product to the US requires a cost-intensive process with many technical tests in the US, the dismantling of this trade barrier is only effective if the European producer designs a new product. Hence a comprehensive free trade agreement that removes tariff and non-tariff barriers will display its full effectiveness only after a period of 10 to 20 years.

Now we know the expected macroeconomic effects of dismantling trade barriers in theory. If we want to quantify the growth and employment consequences we need to make use of economic models. Unfortunately using such models implies certain notable constraints.

Limitations of Economic Modeling

Any economic model is a simplified reproduction of the economic reality. Since economic processes are extremely complex no model is able to reproduce this reality perfectly. Hence economic models are just a rough approximation to real economic operations. To illustrate some of these limitations let us suppose the following example: in 2010 a bottle of wine had a price of €10. During this year consumers bought 1,000 bottles of wine. In 2011 the price rose to €11 and total demand dropped to 900 bottles. In 2012 consumers paid €9 and consumed 1,100 bottles. From these observations we could conclude that an increase in prices of €1 implies a decline of demand by 100 bottles. Unfortunately this conclusion might be incorrect due to at least two reasons.

First of all our observations might be wrong. Maybe in 2011 companies reported wrong sales numbers and were only able to sell 800 bottles. And in 2012 we might have ignored 100 bottles so that the real demand amounted to 1,200 bottles.

Secondly even if we made correct observations we could draw wrong conclusions. Maybe the changes in demand were not caused by a change in prices but by different reasons. For example in 2011 we noted a reduction of demand by only 100 bottles because at the same time consumers enjoyed an increase in available income. Without the higher income total demand would have been dropped to 800 bottles. In 2012 consumers could have changed their tastes. Maybe they preferred beer to wine and thus bought just 1,100 bottles. Without this change in tastes consumers would have demanded 1,200 bottles.

In both cases we draw an incorrect conclusion: in reality a price increase of €1 does not imply a reduction in demand by 100 bottles but by 200 bottles. Of course economists use much more elaborate models. For example, they consider observations covering many years. Moreover the impact of many other variables is considered. Nevertheless the two basic sources of error – wrong observations and wrong conclusions – are always lurking.

To further complicate the issue, even if we could accurately reproduce economic reality, we still have another problem. In order to estimate future economic developments by using an economic model we have to assume that all economic relationships and behaviors we observed in the past hold true in the future. Of course this is by no means guaranteed. Thus even if consumers reduced their demand for wine by 200 bottles if the price rises by €1 during the last 30 years, they still might change their future behavior.

Due to observation mistakes, wrong conclusions, and possible changes in future behavior of economic actors, estimations calculated with the help of economic models are always affected by potential mistakes. Actually such calculations are not forecasts but projections or a conditional statement: if all assumptions turn out to be true we will have the predicted results. But if only one single assumption concerning the behavior of consumers, companies and governments, and the interplay of all these actors and their decisions (including the rest of the world) turns out to be incorrect, calculations about future economic developments would be inaccurate as well. Due to the complexity of global economic relationships, misleading assumptions are inevitable. Hence we know that the estimated developments of our model calculation will not correspond to the real future economic developments. Nevertheless such calculations are valuable because they indicate reasonable spans of economic developments.

Empirical Estimations of Macroeconomic Consequences of TAFTA | TTIP

The following results are taken from a study conducted by the Munich-based ifo Institute and published by the Bertelsmann Stiftung in June 2013. The starting point of this analysis is an econometrical estimation of long term trade effects caused by existing free trade agreements such as the North American Free Trade Agreement (NAFTA) or the European Single Market. With the help of these estimates, the study calculates the trade effects of a removal of tariff and non-tariff barriers for the contracting countries – the US and all EU members – and the rest of the world (for methodological details see Bertelsmann Stiftung 2013, 5-12). Since import duties concerning transatlantic trade are already pretty low, I will only deal with the results of a comprehensive agreement which removes import duties and non-tariff trade barriers (ibid., 21-41).

If the US and the EU had signed such an agreement 10 to 20 years ago, this agreement would have been in full effect in 2010. In that case, in 2010 real gross domestic product (GDP) per capita would have been larger in all economies belonging to this agreement. The US and the United Kingdom would be major winners with an increase of GDP per capita by 13.4% and 9.7% respectively. For Germany the calculations estimate an increase of 4.7%. France would be the country with the smallest gain of real income (plus 2.7%). Stronger economic growth is accompanied by a larger level of employment. Due to a comprehensive bilateral trade agreement, the US would have had almost 1,1 million additional jobs. For the United Kingdom, TAFTA | TTIP is supposed to create 400,000 additional jobs. 180,000 new jobs are projected for Germany, 143,000 for Spain and 141,000 for Italy.

For the rest of the world the intensification of trade relations between the US and the EU has negative economic effects. Countries that suffer most are those economies that already have free trade agreements with the US and/or the EU. For the NAFTA members, Canada and Mexico, for example, TAFTA | TTIP is supposed to reduce long term GDP per capita by 9.5% and 7.2% respectively. Other big losers are Australia, those European countries which are not part of the EU, and all developing economies, especially countries in North and West Africa. Nevertheless, according to these calculations, the world as a whole profits from such an agreement: On the average global real GDP per capita increases by 3.3%.

Conclusion

According to macroeconomic theory, abolition of trade barriers increases real GDP and employment in all signatory states. Hence TAFTA | TTIP ought to boost economic growth and employment on both sides of the Atlantic. The results of model calculations presented in this article confirm these general theoretical expectations. They also indicate that such an agreement has a negative impact on the economic development for the rest of the world. Due to the outlined limitations of economic models it should be clear that the numerical results of these calculations are dependent on the underlying assumptions. Hence other calculations arrive at different conclusions.

A study provided on behalf of the European Commission in March 2013, for example, concludes that TAFTA | TTIP “would not be at the expense of the rest of the world” (Centre for Economic Policy Research 2013, vii). A comprehensive transatlantic free trade agreement would increase long term GDP in the rest of the world by 0.14%. For the EU the increase is supposed to arrive at about 0.5% and the US GDP is projected to rise by 0.4% (ibid., 82). Although economic growth effects are smaller than calculated by the Munich ifo Institute, TAFTA | TTIP is expected to have economic benefits for the US and the EU according to this study, too.

In summary, economists share the belief that a comprehensive EU-US free trade agreement would have positive effects in terms of economic growth and employment in the contracting countries. Economists might disagree on the exact magnitude of growth and employment effects, but I do not know any study that finds GDP and total employment would decline in the US or the EU. On the other hand, estimates regarding the economic consequences for the rest of the world are ambiguous. According to the study of the ifo institute, intensified trade links between the US and the EU take place at the costs of growth and employment in the rest of the world. According to the calculations of the Centre for Economic Policy Research, such negative impacts could be compensated by a global growth impulse generated by TAFTA | TTIP. From the theoretical point of view both developments are possible. Hence we are unable to decide which scenario is more likely. Unfortunately economists will only be able to answer this question 10 or 20 years after the actual entry into force of TAFTA | TTIP.

References

Bertelsmann Stiftung (2013): Transatlantic Trade and Investment Partnership (TTIP): Who Benefits from a Free Trade Deal? Part 1: Macroeconomic Effects.

Centre for Economic Policy Research (2013): Reducing Barriers to Transatlantic Trade and Investment: An Economic Assessment, London.

Tags: Bertelsmann Stiftung, macroeconomic consequences, TAFTA, TTIP