The Rise of Regional Banks

This article was originally drafted by the African Center for Economic Transformation for the newsletter “West Africa Trends” as part of the Rockefeller Foundation’s Searchlight Process. For more Searchlight content on futurechallenges.org, please click here.

As banking in the region has developed, consolidation has created banks big enough to seek markets outside their home countries. At the local level, the mergers and acquisitions have been spurred by stricter capital requirements by central banks. These bigger banks are pursuing new markets as the middle class grows. Branching has also been precipitated by banks following their clients as they expand throughout the region.

Regional integration efforts have also driven the emergence of regional banks. For instance, Ecobank, the largest regional bank so far, is the result of efforts by the West Africa Federation of Chambers of Commerce and ECOWAS. The Sahel – Sahara Bank (Banque Sahelo – Saharienne pour L’Investissement et le Commerce) is also a regional bank established by member countries. The members of the BSIC Group include Ghana, Libya, Sudan, Chad, Gambia, Eritrea, Cote d’Ivoire, Guinea Conakry, Benin, Central African Republic, Togo, Senegal, and Niger.

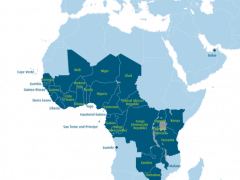

Ecobank global presence 2011. By Ebmediabc (Own work) [CC-BY-SA-3.0 (www.creativecommons.org/licenses/by-sa/3.0)], via Wikimedia Commons

In a second wave of regional expansion the big regional banks have started buying banks in their target countries. For instance Ecobank has acquired the Trust Bank of Ghana and Oceanic Bank in Nigeria. Additionally, Bank of Africa has acquired Amalbank in Ghana as it seeks to establish itself in the country.

Prospects

The trend towards bigger regional banks is likely to continue. The regional banking landscape is also likely to change as other local banks join the ranks of Nigerian banks in size and start branching out. Global banks and banks from other regions of Africa will also join as the industry develops. Bank consolidation will gather pace as economies in the region grow and banking demands increase. Bank regulation is leaning further towards increasing capital requirements. Indeed the global economic crisis has increased concerns about bank capitalization globally.

The growing interest of private equity funds in West Africa will further increase the sizes of sub-Regional banks as financial services is seen as one of the most promising sectors for investment. For example, Kingdom Holding Company of Saudi Arabia invested heavily in the expansion of the two big giants of the region: UBA and Ecobank. Development partners have also been actively supporting the growth of regional banks with IFC and European Investment bank investing in them to expand. This is likely to continue in the future.

Nigeria policy decisions will continue to have a big impact on how regional banking evolves given the disproportionate role Nigeria banks play in the region. Nigeria’s declared intention to become a global banking center by 2020 will also accelerate trends towards bigger banks able to compete globally. To grow to competitive size Nigeria banks will therefore continue their aggressive regional strategy.

Headquarters of the Central Bank of Nigeria in Abuja, Nigeria. By chippla at en.wikipedia [Public domain], from Wikimedia Commons

The Impact of big regional banks

Big banks in the region have the potential to fulfill an important role in promoting economic development as they have the capacity to mobilize huge resources needed to undertake transformative projects that West African economies need, for example, the resources to open up idle land needed for commercial agriculture. Big banks can also build the sophistication needed to handle the complex financial needs of larger corporations such as oil, gas and mining companies. For the poor, who often rely on remittances as a financial safety net, the ability to transfer money across the region is a bonus of regional big banks.

There are also certain risks associated with big regional banks. For example, they tend to be ahead of central banks in terms of sophistication and capacity (they can attract more talent and resources). As a result big banks tend to develop more complex financial products. But while these innovative products develop the financial sector, they are harder to supervise and regulate. They are thus likely to generate deeper financial crises when these products unravel.

Big banks tend to focus on larger customers as they generate their money from fees on transactions and short term lending. They find individual and especially small savers unprofitable as the parameters used to assess profitability are biased towards branches that serve high value clientele. Some even make specific efforts to discourage small savers through high fees on accounts (or high minimum deposits)and not being easily accessible to by locating where the poor cannot reach them. Furthermore, due to their sophistication and resources available, they outcompete small banks in this profitable segment. The end result is that small banks fall out and at the same time since small savers have difficulty banking with big banks, banking services are denied to them.