-

Germany, the Euro and the Euro Crisis

This article is written by Thieß Petersen and it was originally published on e-International Relations under a CC BY-NC-SA 2.0 license. Thieß Petersen is Senior Expert for the project “Global Economic Dynamics” at the Bertelsmann Stiftung in Gütersloh and lecturer at the European University Viadrina in Frankfurt/Oder. In a recent article, […]

Read all posts for ‘Euro’

-

Sovereignty versus Coordination: Is Europe Cured?

Our blogger Josh Grundleger reports about the Bertelsmann Foundation’s fifth annual conference which focuses on economic growth through innovation, global financial governance and the eurozone crisis: “System Upgrade: Time for an Economic Reboot“. It seems the worst of the eurozone crisis is over, at least according to four of Europe’s […]

-

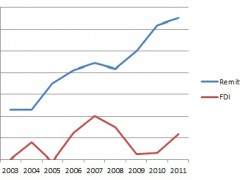

We Can’t Be Hit by the Crisis, We’re Always in Crisis

When the financial crisis hit the Western world, a saying spread throughout Macedonia: ‘We can’t be hit by the crisis, we’re always in crisis’ This was very true at the time. The financial crisis of 2007-2008 brought the collapse of powerful financial institutions and caused a downward spiral in the […]

-

INCRA: Germany’s Top Sovereign-Debt Rating Secure Only With Reform

Our colleagues at the Bertelsmann Foundation in Washington, D.C. have published a new INCRA report. Serious risks to France’s rating; Italy cited for good euro-crisis management WASHINGTON, DC/BERLIN (November 20, 2012) – A downgrading of Germany’s top sovereign-debt credit rating can be avoided only if the country continues to implement fiscal […]

-

Greece’s Withdrawal from the Eurozone Could Cause Global Economic Crisis

Bertelsmann Foundation warns of extensive domino effects Greece’s exit from the Euro bears the risk of kindling a wildfire throughout Europe and possibly even on an international level and may result in a worldwide economic crisis. Countries affected would include not only Southern European nations or EU members, but also […]